Women and Property

Property price growth in the last few years has likely widened inequality between those who own real estate and those that do not. Analysis by CoreLogic suggests women have less share of property ownership than men, meaning they are disproportionately disadvantaged by recent wealth gains from real estate.

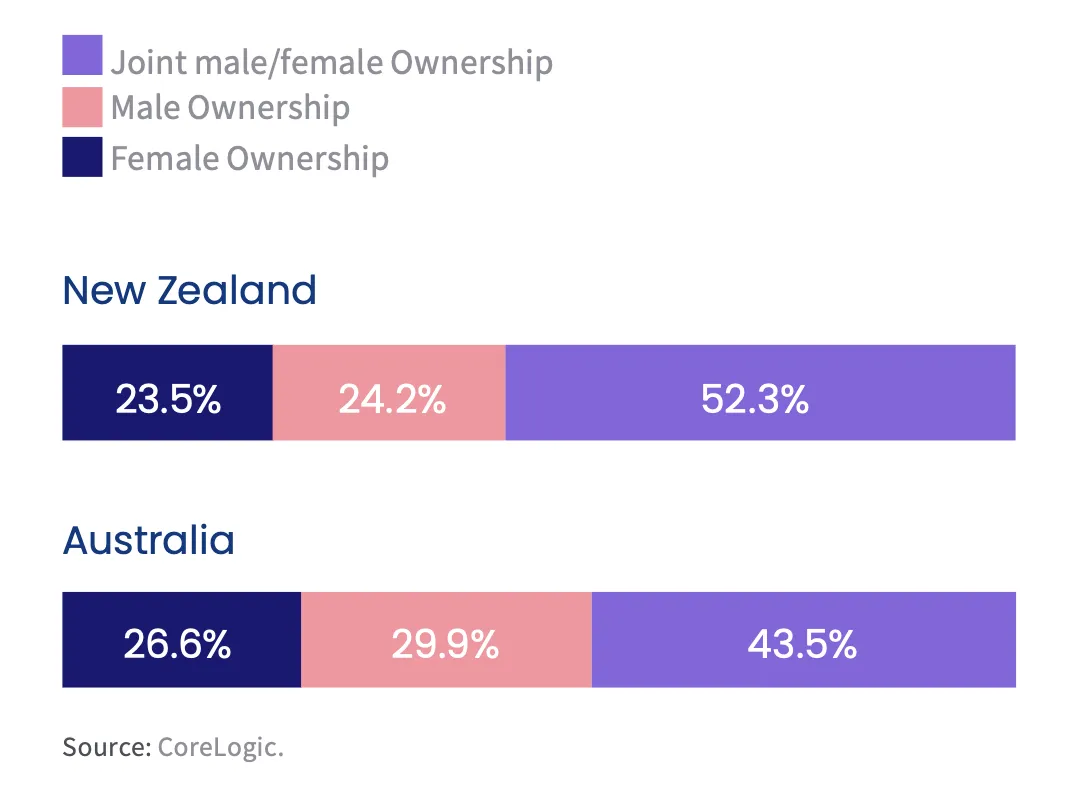

Portion of ownership by gender, Australia and New Zealand

Key findings:

Market share

Men continue to hold the greater share of Australia’s property market but women are closing the gap.

Ownership

It is estimated that over one in four properties analysed is owned by women.

Segmentation

Women are more likely to own property in high value areas including exclusive Sydney suburbs.

Investment property

Men have the edge over women when it comes to investment properties.

Why does property ownership matter?

Dwelling ownership is a pillar of wealth accumulation, and by extension, a comfortable lifestyle in Australia and New Zealand. Housing makes up 55.6% of household assets in New Zealand, with owner-occupied homeowners recording a median net worth of $558,000, compared to $39,000 for renters.

The wealth effect of real estate has multiple implications for households and the broader economy. Research has found:

- periods of house price increases are correlated with greater vehicle registrations at a postcode level

- house price growth and ownership can increase fertility intentions among women

- the security of ownership may make women feel more empowered to have children

- real estate ownership reduces the likelihood of poverty by retirement age. Poverty rates are 42% among renters over 65 in Australia compared with merely 6% of outright home owners

- housing serves a source of equity which can play an important role in funding aged care

The gender pay gap is real

The gender pay gap actually rose slightly between 2020-2021. One of the implications this pay gap has for property ownership is that men, on average, have a greater potential for faster accumulation of a home loan deposit.

While full time earnings constitute the official measure of the gender pay gap in Australia, women are overrepresented in part time employment, which tends to attract lower pay.

Further implications for the gender wealth gap between men and women are that men own a higher portion of houses (29.9%) than women (25.7%) and houses have generally had greater capital appreciation over time.

Help for Single Parents

In the Australian 2021-22 Federal Budget, the government introduced the ‘Family Home Guarantee’, which is aimed at supporting 10,000 eligible single parents into the housing market with a deposit as low as 2%. While this scheme is available for any gender, it will likely support more women, who made 63.5% of single parents in the 2016 census. If you would like to check your eligibility, contact our sister company Altitude Finance

The Good news is more Women are investing

We are in a time of pivotal change. More women are investing than ever before. During the lockdowns of 2020, women made up 45% of all new investors in Australia. It’s a trend that looks set to continue and as more women start investing. Their investment approach will shape the markets of the future.

In previous times, property investment, buying a home, building a business, and every other major decision was made predominately by men. But now the dynamics have, and are continuing to change. Women today have more confidence and are proven dynamo's when it comes to managing the household (and the budget), health, business and everything in between.

Summary

We need to nurture and up-skill Men and Women alike when it comes to finances to ensure we can create harmony in our lives without the stress and poverty that lack of financial education contributes to.

For help or to talk through anything in this article, please contact me. I would love to hear from you!

About my journey

I began investing in property at age 26. I was a true rent-vestor (renting while investing). One of the best ways to get started especially if you're young and want to keep renting in places you can't afford to buy (yet). Together with my partner we became home and investment property loan specialists and advisers to hundreds of clients.

There are endless benefits of home ownership and property investment and I've personally witnessed how these benefits have changed the lives of many families and the future for generations to come. The ripple effect.

What do you need to do to start your journey?

If you've been sitting on the side-lines telling yourself property ownership is not possible for you, then let's challenge those assumptions.

You might not be ready (yet) but with some guidance, education and financial skills anything is possible.

Warm wishes,

Personal Finance Coach - Empowering you to be in control

Source: CoreLogic Women in Property Report 2022

Disclaimer: this content does not constitute advice and should not be relied upon as such. Cashflow Mastery is for educational purposes only. It is not to be taken as Financial, Taxation, or Legal advice. Full terms are found on our website.