What's on your Credit Report and why is it so important?

Almost 80% of us have some form of credit. The most common types of credit are Home loans, Credit cards, Vehicle finance, Personal loans and Buy Now Pay Later services.

To get credit, a lender will firstly look at your credit report. Your report is a key indication if you are a good borrower and will determine if a potential lender will lend to you and at what rate.

A credit report is extremely important because it can affect your finances and your ability to qualify for a property, car or even a job.

Here are the top questions we get asked. We had a chat to Larni, a credit repair specialist to pick her brain and help us answer these:

- What is a credit report

- How is a credit report created

- Where do people apply for a credit report

- What is listed on a credit report

- How many times should you check your credit report and why should you check

- What is bad credit and how can it affect me and my credit report

- Can bad credit be removed and if so how?

- If I don't have bad credit how canI maintain a healthy credit report and score?

Larni is the owner of Wipe Credit Clean she has been in the credit repair industry for 7 years and opened her business in 2020. To date she has removed over 1300 listing and given close to 800 consumers a second chance on having financial freedom!

Check out the Interview with Larni from Wipe Credit Clean

What is good credit score?

Generally a score above 625 depending on the credit reporting body. These are the 3 in Australia:

- Equifax: 500 to 699 (or higher)

- Experian: 661 to 734 (or higher)

- Illion: 625 to 699 (or higher)

Above 800 is considered excellent. Below 500 is considered low.

A good credit score will help you:

- Negotiate better rates and terms

- Increase your chances of credit approval

- Get lower rates on personal loans

- Upgrade your phone plan / obtain a utilities account

- Provide wider options in and lower interest rates

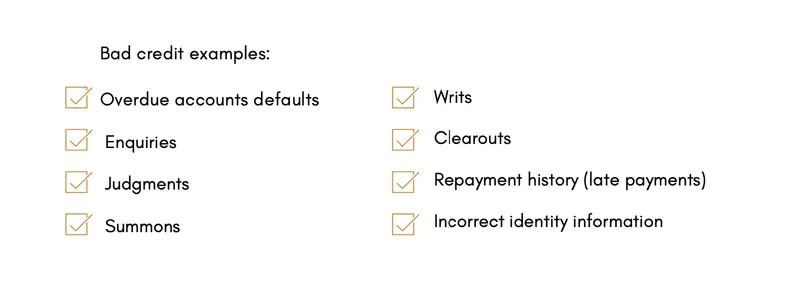

What about bad credit?

Credit scores between 0-500 are considered bad or low. Bad credit can potentially stay on your credit file for five to seven years. Contrary to common belief, paying the debt does not remove the bad credit.

The consequences of having bad credit can result in severe financial hardship, much higher interest rates or even the inability to obtain the essentials like a mobile phone contract or utilities.

6 Top Tips for building (and keeping) a healthy Credit Report

1. Check your credit report/score

You can't improve what you don't know about. You can apply for your free report with Equifax here: www.equifax.com.au/personal

2. Don't apply too often and watch out for Buy Now Pay Later

How many times and how often you apply for credit will adversely affect your credit score. The lower your score, the less options you will have.

Missing 'buy now pay later' repayments will impact your score. Some BNPL providers are now putting an enquiry on your file which wasn't always the case.

3. Be aware that lenders will advertise 'rates from "X" that lure you in

Be aware that each time you put any personal details into a lenders website you are subject to having an enquiry placed on your file. Even if you don't proceed!

Merely looking at your options and doing random comparisons can be to your detriment. Unless your score is excellent (as well as other factors) chances are you won't qualify for their advertised rate.

4. Always pay your debts (on time)

This is crucial. Late payments are a no-go for any lender considering lending to you. They want to lend to people who are good payers and ensure they will get their money back.

If you move house, it's your responsibility to update your current details so that no mail goes unchecked. Moving house is one of the biggest reasons people miss payments or get a credit default slapped onto their file.

5. Use an experienced Finance Broker

A good broker will check your credit file before doing anything. They help you navigate the main purchases you make especially when it comes to property, cars and personal loans.

They will know which lender you have the highest chance of success with. It's a no-brainer as they do all the important research and leg work to get the right deal for you. Avoid applying to multiple lenders simultaneously as this will automatically lower your score!

Some lenders simply won't touch you if your score is below 600 for example. Others happily will. It also depends on what type of finance you are going for.

Car finance and personal loans are generally easier to qualify for than a Mortgage but again credit score is very important (as well as other criteria).

6. Regularly check your file

Know what enquiries have been listed - either yours or worse still someone else's! Identity theft is rife, so you also need to ensure no fraudulent activity is taking place on your file.

If you have bad credit - do not despair All is not lost. First thing is to talk with Larni from Wipe Credit Clean. She will be able to guide you and to see if you can wipe any of it clear. Contact her at www.wipecreditclean.com.au

Summary

It may take some time to rebuild your credit score if it's low. The key is to:

- Pay all your debts on time

- Stop applying for finance

- Contact a finance broker to help you (Altitude Finance our sister company can help)

- Protect your credit file at all costs!

Avoid making the same mistakes, seek out the help and guidance you need to create a brighter future financially - it's yours for the taking!

Eliminate bad debt - FAST

If you have more than 3+ consumer debts (credit cards, car loan, personal loan, Zip pay etc) and you're drowning unable to get ahead, then check out The Debt Buster Program This course will help you eliminate bad debt and create new habits to ensure it stays that way.

Contact me for more information on anything in this article or to find out how a money coach can help you get to your goals easier and faster!

Money Coach - Empowering you to be in control

Disclaimer - this content does not constitute advice and should not be relied upon as such. Cashflow Mastery is for educational purposes only. It is not to be taken as Financial, Taxation, or Legal advice. Full terms are found on our website.