5 Women share the best piece of wealth advice they ever received

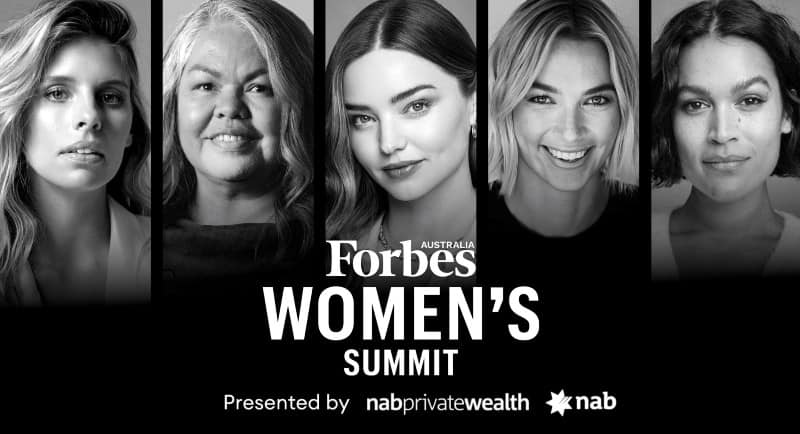

The Forbes Women's Summit is coming up on 22 March in Sydney, Australia. What a line up of speakers. This event is in celebration of International Women's Day on 8th March.

Why do we celebrate Women's Day on March 8?

It began in New York City on March 8, 1857, when female textile workers marched in protest of unfair working conditions and unequal rights for women.

International Women's Day is a global holiday celebrated annually on March 8 as a focal point in the women's rights movement, bringing attention to issues such as gender equality, reproductive rights, and violence and abuse against women.

No matter your views, it's a wonderful opportunity to celebrate all things woman. Men are by means excluded. Plenty of men attend the Women's Summit and stand side by side their women to celebrate and mark the significance of this day.

My particular interest is around Women gaining the knowledge and confidence to make better, more informed financial decisions for themselves and their families. During my time working as a finance advisor and coach, I come across so many capable women who lack the confidence and skills to get ahead financially. With more women in business and managerial roles the tide is slowly changing which is extremely encouraging.

Let's turn our attention to the inspiration and advice being shared by some fellow sisters in business. 5 women on the line up of speakers share the best piece of wealth advice they ever received.

Sam White, founder of Freedom Services Group and Stella Insurance Australia

I’ve received some great advice throughout my entrepreneurial ups and downs. Arm yourself with as much ammo as you can, and by ammo I do mean knowledge. Knowledge in this world is key and will take anyone a long way – if you know how to use it effectively. With knowledge comes a clearer mindset, as businesswomen our mindset is the single most important factor for everything in life. When it comes to challenges and failures, remember it’s never as bad as you think it is. Nobody’s watching, so don’t assume that other people are judging what you are doing and be as confident as you can.

Wendy McArthy AO, businesswoman, activist and former Chancellor of the University of Canberra

Probably the best advice I ever got was to be a homeowner. It was my mother’s instinctive advice. It fulfils a primal need and will be your base capital for the rest of your life if you manage it well. It provides security which can enable you to take risks when families change shape and shift. For me that was in my sixties when children had finished education and I had some disposable money. I became a cautious investor in businesses I understood. I invested in some of our cattle and began developing a balanced portfolio which as a widow now stands me in good stead.

Maria Lykouras, Executive, JBWere

The best piece of wealth advice I’ve received is the real value of having your own financial adviser. We are inherently emotionally attached to our own money, which means it can be difficult to make rational and objective decisions. This is why it’s important to have the guidance of a financial adviser to help put in place a plan that is tailored to the specific goals that we set for ourselves, our businesses and our family. Great advisers hold us accountable throughout market condition fluctuations, major life or financial changes, with the goal of protecting and growing wealth.

Martina Crowley, Private Clients National Leader, PwC

The best time to start investing was 20 years ago, the second-best time is today. The advice was based on the Chinese proverb that “The best time to plant a tree was 20 years, the second-best time is now”. Building wealth is quite similar.

Michelle Battersby, co-founder and chief marketing officer, Sunroom

Jay Z’s famous line, “If you can’t buy something twice you can’t afford it,” lives in my head rent free and serves as a reminder to not live beyond my means. Of course, I don’t feel this applies to something like buying a home (and easy for Jay Z to say!) but it’s worthy of consideration in most other situations.

A mentor recently said to me “if you want advice ask for money, if you want money ask for advice”. The land of Venture Capital is such an interesting one. It feels a lot like dating at times and this piece of advice really stuck with me. The pressure is off when you’re asking someone for advice and you have a solid opportunity to give them an insight into your wins/challenges at the same time, which can be a really good building block for future investment.

In Summary

As Martina Crowley said, it's never too late to start! If you want to learn more about investing or simply get on-top of managing your money, I'm all in and here to help you.

You can do this by requesting a complimentary consult with me here.

If you prefer to learn at your own pace, then The Empowerment Program which I have designed and put together as an online course is a great place to start.

You just need to make the decision to start!

Warm wishes,

Personal Finance Coach - Empowering you to be in control

source: Forbes Australia